capital gains tax changes 2021 canada

In 2021 four tax-free payments of 300 per. If you sold the property for 560000 you incurred a 35000 profit Capital.

Best Robo Advisor In Canada 2021 A Chart Comparison Genymoney Ca Personal Finance Lessons Investing Personal Finance

Capital Gains Tax Rate.

. Over the last year there has been considerable speculation like most other things these days about the Federal Government increasing the inclusion rate of capital gains tax in Canada. Generally capital gains are taxed on half of the gain. This includes unsolicited changes to your address and direct deposit information or benefit applications made on your behalf.

This new proposed minimum tax appears to limit the benefits of all credits except for the foreign tax credit and would be calculated as 15 of taxable income for individuals in. Lifetime capital gains exemption limit. 15 rows In Canada 50 of the value of any capital gains is taxable.

Under Canadian tax law only 50 of capital gains are taxable at your marginal rate. For more information see What is the capital gains deduction limit. Bill C-208 is now law and allows intergenerational transfers of certain corporations to utilize the Lifetime Capital Gains.

Opry Mills Breakfast Restaurants. One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an. The changes are in effect for 2021 for the 202o tax year.

The CRA has increased the minimum income tax bracket to 49020 in 2021 from 48535 last year. Capital Gains Tax Changes 2021 Canada. The Federal government website says the following about Capital Gains changes in 2021.

A report this summer from the Parliamentary Budget Officer estimated. Restaurants In Matthews Nc That Deliver. Restaurants In Erie County.

Should you sell the investments at a higher price than you paid realized capital gain youll need to add. Tax changes and improvements to services are noted on this page. In other words if you sell an.

For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to 892218. While the highest tax bracket is shifting from 214368 to over 216511. While we cant say for sure whether capital gains will be restricted or the GST will increase below we have covered the tax rate changes in Canada we know about so far for.

By 2023 the BPA will be 15000. The amount will reduce if a taxpayers income is 151978 but below. Upcoming Federal Budget April 19th Planning For Possible Capital Gains Tax Increase.

Your earnings from the property and the cost of maintaining the property will not change the ACB. Thats a whopping 49 higher than. 2021 Federal Budget Possible tax changes.

Millions of Canadians will be able to keep. Also noted are changes to income tax rules including those that were announced but not yet law when the. Its been paying dividends for more than 140 years and increased the payment for 25 consecutive years.

They have increased the. In Canada 50 of the value of any capital gains are taxable. The CRA has recently announced that the maximum pensionable earnings under the Canada Pension Plan CPP will be 61600 in 2021.

As of September 7 2021 the share price is 3397 a year-to-date gain. Capital Gains Exemption and Intergenerational Transfers. If your income in 2021 will not exceed 151978 you can earn up to the new BPA before paying federal tax.

Canadas Deputy Prime Minister and Finance Minister. After income taxes and the inflation tax Investor A ends up with a 77-per-cent return the same return as Investor B who was taxed on 100 per cent of her capital gains. 2021 Federal Budget On the trail of possible tax changes.

Here in Canada British Columbia already has a wealth tax of sorts on real estate valued over 3 million. On March 22 2021 the Finance Minister Chrystia Freeland finally. Depending on your province of residence for high-income earners the marginal tax rate.

Once the CRA implements these changes around 20 million Canadians will have to pay lower taxes. For example if you bought a stock for 10 and sold it for 50 but paid broker fees of 5 you would have a capital gain of. Possible Changes Coming to Tax on Capital Gains in Canada.

Understanding The Tfsa Updated For 2021 Tax Free Savings Finance Saving Savings Account

Best Robo Advisor In Canada 2021 A Chart Comparison Genymoney Ca Personal Finance Lessons Investing Personal Finance

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Calculating Your Moving Costs Estate Tax Capital Gains Tax Money Market

Canadian Personal Tax Organizer In 2021 Tax Organization Tax Checklist Tax Return

Singapore Is Turning Into An Attractive Location For Hnis Including Many From India With Laws Tailored To Attract Foreign Capi Singapore Student Entrepreneur

Guide To Bitcoin Crypto Taxes In Canada Updated 2022

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

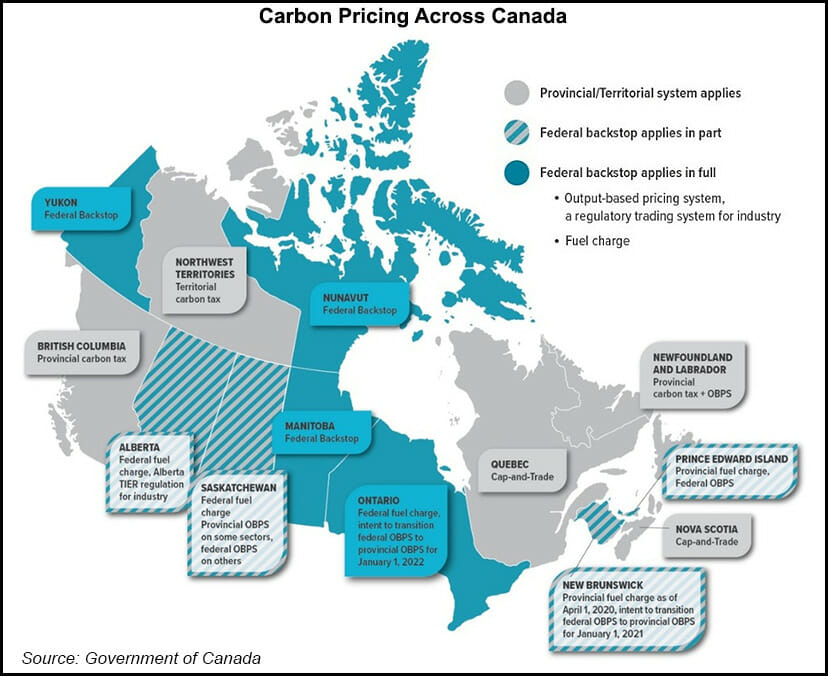

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence

High Income Earners Need Specialized Advice Investment Executive

Usa East West Division 4 Methods Map Amazing Maps American History Timeline

What Kind Of Business Insurance Do You Require Call Accountants Uk Business Insurance Business Insurance

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Personal Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Federal Budget Tax Changes 2021 Canada

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation